However if you do not own your panels whatever value that they may add cannot be included for an fha assessment.

Appraisal should an adjustment be made for solar panels financed.

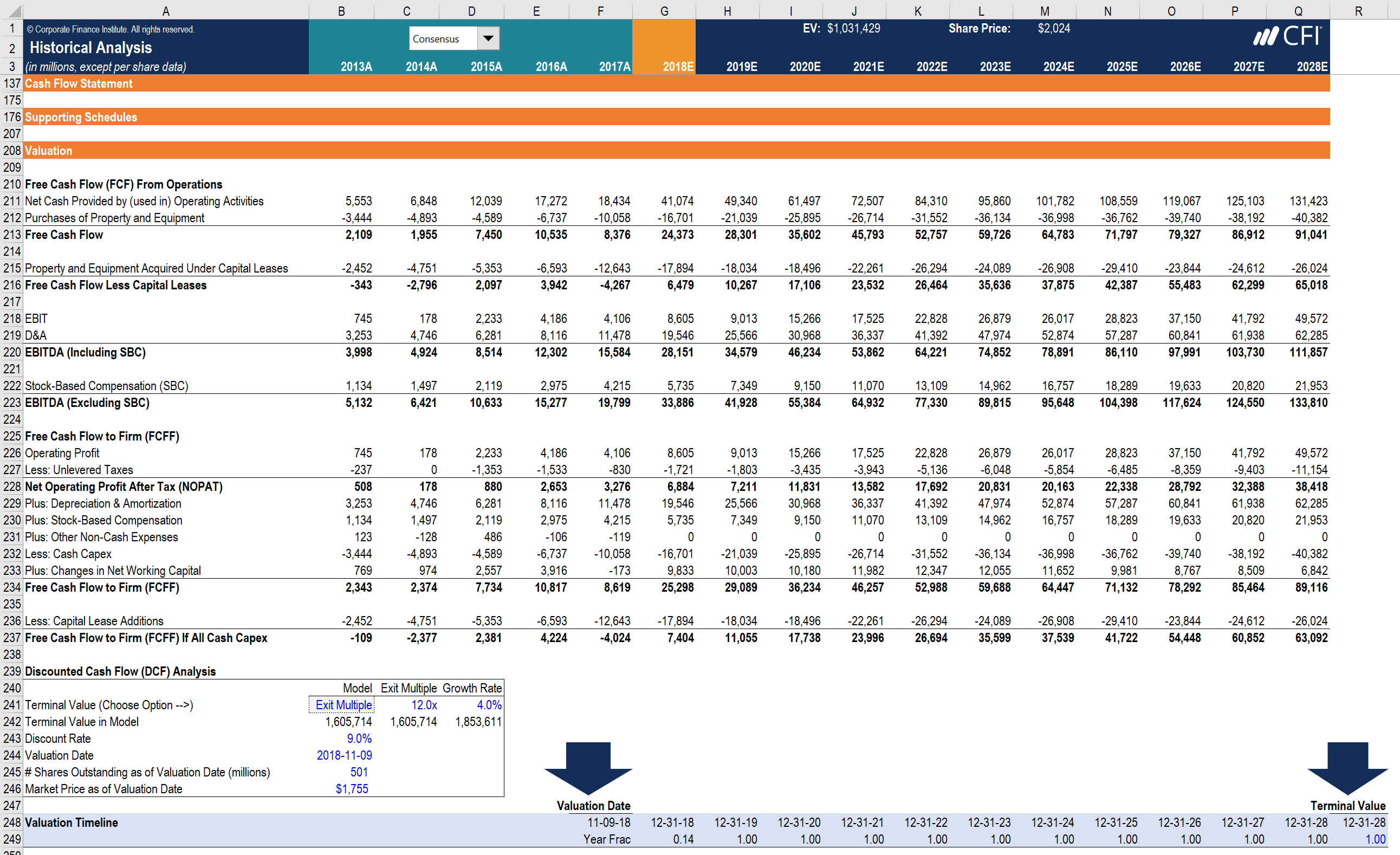

A refinance may require an appraisal but should address the value the system may or may not add to the property.

The only solar system which deserves a boost in the appraisal analysis is an owned system.

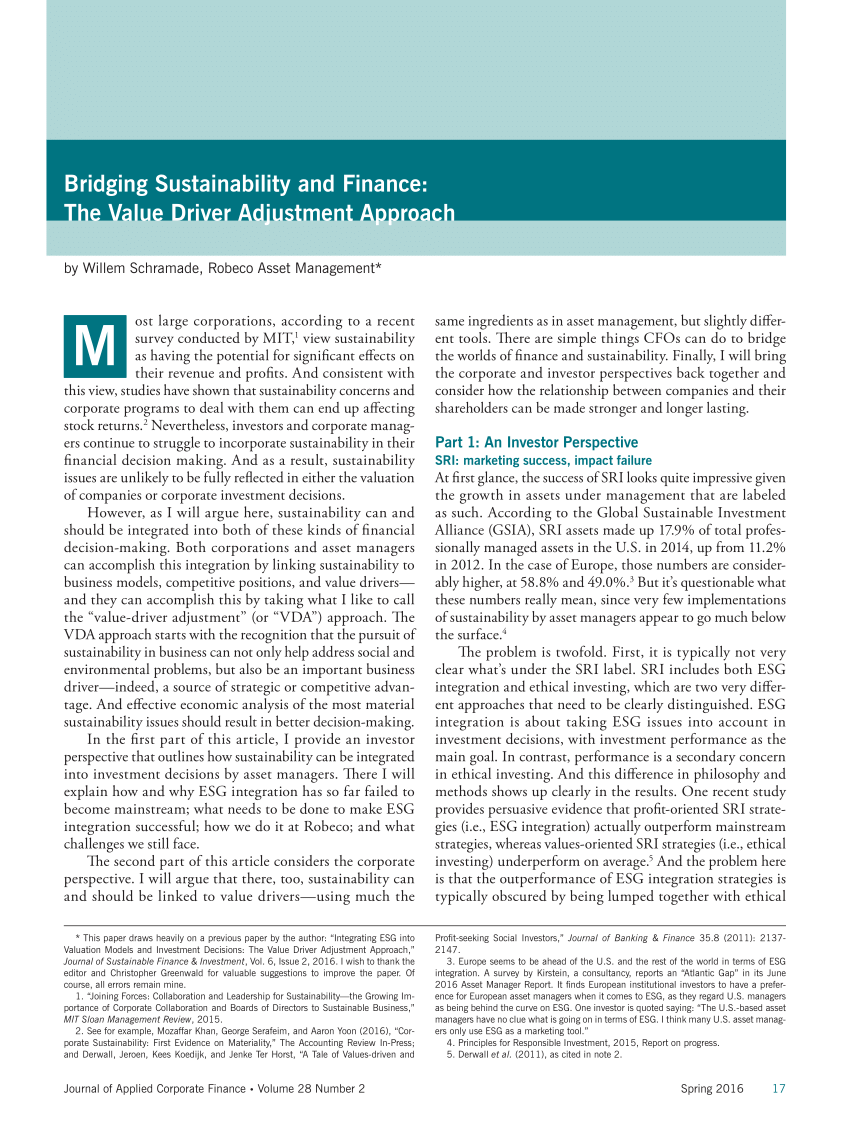

For an overview of solar panels methods of valuation and challenges of appraising properties with solar check out our recorded webinar appraising solar panels.

Otherwise it s as much of a leased responsibility as it is a benefit given the uncertainties over the long term.

Solar panels financing through a loan that has since been paid in full means that you are now the owner of the system.

This can be avoided by refinancing the house to finance the system.

A primer presented by instructor mark buhler.

Many appraisers are taking the position that there is no added value and perhaps some diminished value with leased solar panels because the buyer must assume the lease.

This additional financial commitment makes it harder to market and sell the property.

Whether the solar panels are leased and owned also may affect the appraisal.

When the system is collateral for the loan it should not be mortgaged over.

The interest rate on a refinance is typically lower than a solar loan.

The listing agent and the appraiser should ensure that comparable market sales data included in the cost evaluation consider any available homes with solar panels sold nearby or otherwise account for the added value of your solar panels compared to homes without solar.

If your solar panel system is financed via an unpaid loan you are obliged to make monthly payments to cover your debt ownership depends on the contract signed with the lender.

/Sinking-fund-factor-1bb9180a4a4340c79a7c3cf470a907ca.jpg)

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)